1099-NEC Printable Template

Fill Out the 1099-NEC Form Online for Free

Get FormWhen managing non-employee compensations, it is vital for businesses to comprehend the structure of the IRS Form 1099-NEC clearly. This form is crucial in reporting payments to independent contractors and service providers. Simply put, the 1099-NEC form printable for 2023 has specific sections to be meticulously filled out, ensuring all necessary data is captured accurately.

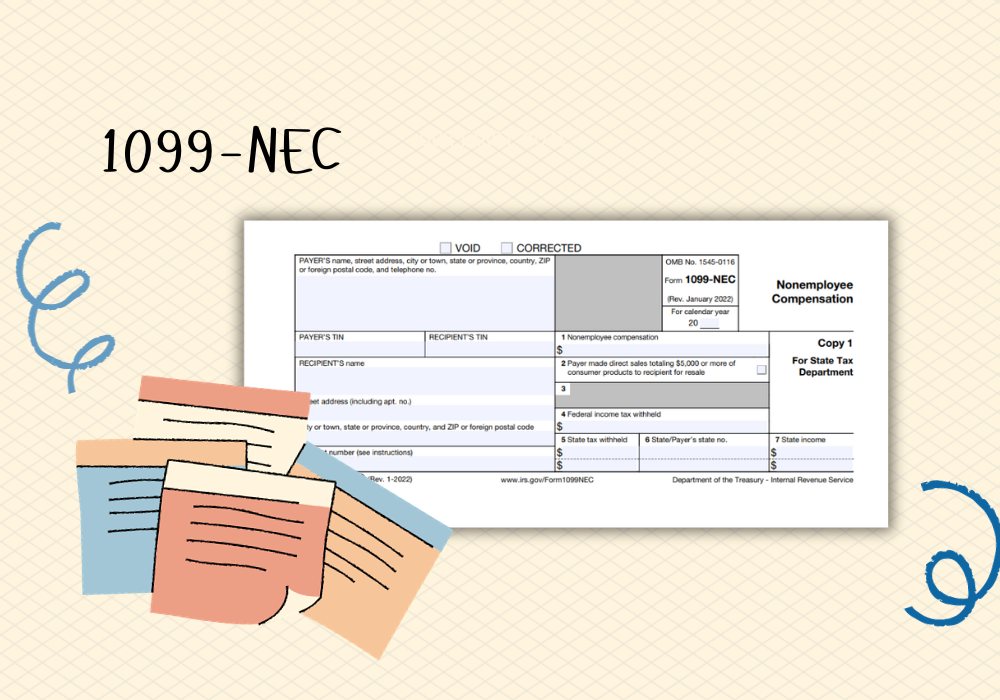

Layout of IRS Form 1099-NEC

The boxes at the forefront of IRS Form 1099-NEC printable indicate the payer's information, recipient details, and payment totals. The payer's details should include the name, address, and Taxpayer Identification Number (TIN), while the recipient's section showcases their TIN, name, and address. Most paramount is the box indicating the non-employee compensation amount, which reflects all payments made during the tax year exceeding $600.

Completing IRS Form 1099-NEC Correctly

- Recipient's Information

Ensure the contractor's legal name and address match their tax records to avoid filing errors. - TIN Verification

Reconfirm the Taxpayer Identification Numbers (TIN) for both the payer and recipient to prevent potential discrepancies with IRS records. - Compensation Amount

Accurately report the total amount paid to the contractor in the dedicated box, including any fees, commissions, or other compensation surpassing the $600 threshold. - State Reporting

If required by your state's tax regulations, complete the state information section to ensure compliance with local tax obligations. - Review Each Copy

Double-check the information across all copies of the 1099-NEC to ascertain consistency and accuracy before distributing and filing.

Filing the Printable 1099-NEC Form

Upon completion, filing Form 1099-NEC must be done methodically. The primary step involves distributing the relevant copies to the recipient, the IRS, and possibly your state tax department. The recipient should receive Copy B, while Copy A is for IRS submission, attained using a 1099-NEC printable template provided by the IRS or authorized tax software. If electronic filing is not an option, send the A Copy along with Form 1096 (Annual Summary and Transmittal of U.S. Information Returns) to the IRS.

Deadline for Form 1099-NEC for 2023

Impress upon the importance of timely submission. The deadline to file the printable 1099-NEC form for 2023 to the IRS typically falls on January 31 for the previous tax year. In effect, this means payments recorded for the tax year 2023 must be reported no later than January 31, 2024. However, if the deadline lands on a weekend or public holiday, it's adjusted to the following business day.

By attending to the format, completing the form with accuracy, and adhering to filing deadlines, businesses can confidently navigate the intricacies of tax reporting for independent contractors. Utilizing resources such as a 1099-NEC printable template can streamline the filing process, propelling businesses toward a successful tax season.