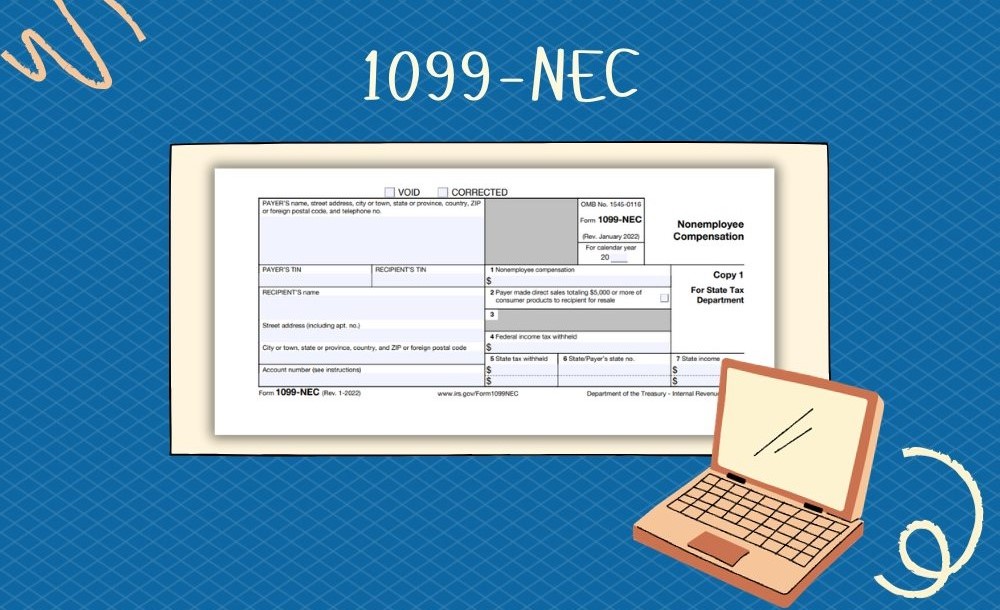

IRS 1099-NEC Form for 2023

Fill Out the 1099-NEC Form Online for Free

Get FormTaxation is a crucial aspect of financial management both for businesses and independent contractors. The IRS requires that the 1099-NEC form, which stands for Nonemployee Compensation, be used by business owners to report payments made to freelancers, independent contractors, and other non-employees that exceed $600 in a year. This form is part of the accurate reporting and compliance measures that enable the IRS to ensure proper tax payments are collected.

Key Changes in Form 1099-NEC for 2023

For those gearing up to file the 1099-NEC for 2023, it's essential to be aware of any updates or changes to the form from the previous tax years. The IRS occasionally revises tax forms to reflect current tax laws or to simplify the reporting processes. By staying informed about these changes, taxpayers can avoid common mistakes and ensure timely compliance with tax regulations.

Determining the 1099-NEC Form Using Terms

When identifying who should be using the form, it's vital to consider the nature of the business relationship between the payer and the payee. Generally, the form is employed when an individual or entity pays a non-employee $600 or more for services rendered in the course of the payer's trade or business during the year. Conversely, employees who receive a salary or hourly wage are not provided a 1099-NEC but instead receive a W-2 form reflecting their compensation and withholdings.

Comparison: 1099-NEC vs. 1099-MISC

To clarify the distinctions between forms 1099-NEC and 1099-MISC, it is helpful to look at them side by side:

| 1099-NEC | 1099-MISC |

|---|---|

| Used to report nonemployee compensation | Used for various other payments like rent, prizes, and medical payments |

| Required for payments totaling $600 or more in a year | Payment thresholds vary depending on the type of payment |

| Has a strict filing deadline, typically January 31 of the following year | Filing deadlines can vary depending on the payment types being reported |

Accessing accurate and official tax forms can sometimes present challenges; however, businesses and contractors can obtain a printable 1099-NEC form for 2023 for free through the IRS website or reputable third-party sources. This ensures compliance with no additional cost for acquiring the necessary forms.

2023 Form 1099-NEC: Our Recommendations

- For those preferring a digital option, the IRS also provides a fillable 1099-NEC form for 2023. This version can be filled out directly on a computer and then printed or submitted electronically if the user has the appropriate software and authorization to do so.

- Furthermore, taxpayers looking to obtain the form without navigating the IRS website can search for a 2023 1099-NEC in PDF format online. Such PDFs are particularly beneficial for those comfortable with electronic filing or for keeping a digital record of their tax documents.

In summary, the 1099-NEC form is integral for those conducting business with independent contractors and ensures the IRS can accurately track compensation unrelated to traditional employment. As tax laws and forms evolve, it's imperative to stay informed and make use of available resources like the printable 2023 1099-NEC form to remain in good standing with the tax authorities.